5 must-have software for accounting and CPA firms in 2025

Successful accounting and CPA firms use the right tools. Discover the top five best software for accounting firms currently on the market.

As the accounting industry undergoes transformation, one crucial requirement has become increasingly prevalent — a need for unparalleled client service. Embracing this paradigm shift, innovative firms are redefining the client experience by incorporating cutting-edge software for accounting firms that streamlines workflows, elevates productivity, and fosters seamless communication.

In this article, we dive into the top five software offerings that have proved to be game-changers for CPAs and accounting firms in 2025. These transformative tools empower modern accounting firms to revolutionize their practices, elevating their client services to new heights. Let’s get into it.

What type of software do accounting firms use?

Accounting firms rely on diverse software solutions to manage their operations, streamline workflows, and provide exceptional services to their clients. As technology continues to revolutionize the accounting industry, specialized software for accounting firms plays a pivotal role in optimizing various aspects of accounting practices. The following key types of software are those that accounting firms commonly utilize.

Accounting software

Accounting software is the backbone of every accounting firm, facilitating fundamental financial tasks such as bookkeeping, invoicing, and financial reporting. These platforms offer comprehensive features to manage income and expenses, track financial transactions, generate customized reports, and ensure compliance with tax regulations. With intuitive interfaces and seamless integrations, these software solutions streamline accounting processes, enabling firms to maintain accurate financial records and provide reliable financial insights to their clients.

Tax preparation software

Tax preparation is a critical aspect of accounting services, and tax preparation software simplifies the complexities involved in preparing and filing taxes. These software tools guide accountants through various tax forms, calculations, deductions, and credits, ensuring accurate and timely tax filings. With built-in error checks and up-to-date tax information on laws, tax preparation software minimizes the risk of errors and maximizes tax efficiency for both accounting firms and their clients.

Audit software

For accounting firms engaged in auditing services, specialized audit software for accounting firms offers indispensable assistance. These platforms enable auditors to perform comprehensive data analysis, identify anomalies, and assess internal controls with greater efficiency and accuracy. By automating various audit procedures, these software solutions enhance audit quality, shorten the audit timeline, and provide valuable insights to clients, helping them make informed business decisions based on reliable financial information.

Project and document management

Efficient project and document management tools are vital for accounting firms to stay organized, collaborate seamlessly, and maintain confidentiality. Platforms like Asana and Monday.com offer intuitive project management features, allowing firms to track deadlines, allocate resources, and monitor project progress efficiently. Meanwhile, Google Drive shines as a popular cloud-based storage solution, providing a secure and centralized repository for important documents and facilitating easy file sharing and collaboration.

Client communication, CRM, and portal software

Communication is the cornerstone of successful client relationships, and client communication and management software like Assembly empowers accounting firms with effective communication channels. Assembly provides a centralized client portal, allowing firms to securely interact with clients, share documents, and exchange messages in real-time. With integrated CRM capabilities, Assembly streamlines client relationship management, ensuring personalized interactions, and efficient client services. The portal functionality enhances collaboration and transparency, fostering strong client-accountant relationships.

5 best software for accounting and CPA firms

By incorporating the following types of software for accounting firms into their practices, forward-thinking firms will be poised to thrive in 2025 and beyond.

Here are the different types of software for accounting firms:

- Accounting software

- Tax preparation software

- Audit software

- Project and document management

- Client communication, CRM, and portal software

Let’s take a closer look at each type of software for accounting firms.

1. Accounting software

Here are a few popular accounting tools used by accounting and CPA firms:

QuickBooks

As an accountant, you may already have QuickBooks tucked into your toolbox as an indispensable asset to your organization. Whether for bookkeeping or strategic advising, the platform offers a variety of tools, educational resources, and community support to help both new and established accountants manage their practices.

Built by Intuit, QuickBooks Online Accountant provides a variety of features for managing your own practice as well as client work. For accounting practices, the platform enables income and expense tracking, invoicing, bookkeeping, and other aspects of financial management.

QuickBooks also stands out as a training hub, with its QuickBooks Accountant University, QuickBooks Certification, and the ability to earn CPE credits. When you sign up for QuickBooks Online Accountant, you also get automatic access to its ProAdvisor resources designed to help you grow your client base and uplevel your skills. With ProAdvisor, you can list your firm for free after earning your QuickBooks Certification, allowing you to promote your certifications and specialized skills among prospective clients.

In terms of client management, it allows you to manage all your clients in one central location. Streamline communications, organize their financial data, gain insights into their financial health, and collaborate when it matters most. Automation takes repetitive tasks off your plate to save you time and reduce errors.

Rating and reviews for QuickBooks:

- G2: 4.0 out of 5 stars, based on +3,383 user reviews.

- Capterra: 4.3 out of 5 stars, based on +7,752 user reviews.

Xero

Another popular option among accounting firms and small businesses is Xero, which offers a number of features designed to help accountants save time and tighten up their operations. The platform stores and protects data in one location while automating routine tasks like sending invoice reminders and reconciling bank transactions. Xero’s mobile app also makes it easy to access data from anywhere, including invoicing, payroll, and more.

With Xero, accounting firms can efficiently handle bill payments, ensuring timely and organized cash flow management. The expense management tools streamline expense claims, simplifying spending management and reimbursements. Bank connections with Xero enable seamless bank feeds, automatically updating transactions daily for accurate financial records.

Reduce the time spent chasing down payments with Xero’s invoicing capabilities. You can also utilize job tracking tools to quote, invoice, and receive payments efficiently while keeping track of costs and profitability. Moreover, Xero integrates with Gusto payroll software, simplifying payroll calculations, payment, and accounting updates.

Meanwhile, accurate accounting reports and analytics provide insights into financial health and cash flow management. With multi-currency accounting, Xero supports transactions in over 160 currencies, including instant currency conversions.

Rating and reviews for Xero:

- G2: 4.3 out of 5 stars, based on +714 user reviews.

- Capterra: 4.4 out of 5 stars, based on +3,080 user reviews.

Sage 50

Rounding out our shortlist of CPA software tools is Sage 50, which offers a comprehensive suite of powerful accounting and finance features. With Sage 50, you can focus on your core operations while gaining clarity on business performance, reducing administrative tasks, and freeing up valuable time.

With its cash-flow and invoicing capabilities, Sage 50 enables businesses to run frequent what-if scenarios, ensuring a clear understanding of their financial standing by staying on top of incoming and outgoing cash flow. The software’s payments and banking features streamline transactions by eliminating manual data entry and automating bank reconciliation, simplifying both payments and receipts in one centralized area.

Sage 50’s job costing feature provides control over project costs through easy setup via records, phases, and cost codes, offering insights into revenue generation and profit-maximizing opportunities for each project. Moreover, Sage 50’s payroll functionality ensures timely payment to employees and compliance with accurate tax calculations for withholdings, e-filing, and automated W2s and tax forms.

The reporting capabilities of Sage 50 are highly customizable, allowing businesses to generate one-click reports tailored to their specific needs. With the ability to run unlimited reports on sales taxes, expenses, profits, and more, Sage 50 equips businesses with essential financial insights to drive growth and success.

Rating and reviews for Xero:

- G2: 3.9 out of 5 stars, based on +140 user reviews.

- Capterra: 3.9 out of 5 stars, based on +397 user reviews.

2. Tax preparation software

Here are a few popular tax preparation tools used by accounting and CPA firms:

TurboTax

Another Intuit product, TurboTax offers both DIY and full-service tax preparation through intuitive software that offers a wide range of features and benefits for accounting firms seeking efficient and reliable tax solutions. With TurboTax, accounting firms can streamline their tax preparation processes, enhance client services, and optimize their tax workflows.

One of the key features of TurboTax is its user-friendly interface, making it accessible and easy to use for both accounting professionals and their clients. The software guides users through the tax preparation process step-by-step, ensuring accurate and thorough completion of tax forms and calculations.

TurboTax offers various versions to cater to different tax scenarios, including individual tax returns, small businesses, corporations, and more. This versatility allows accounting firms to handle diverse client needs efficiently from within a single platform.

The software provides comprehensive support for tax deductions and credits, ensuring that clients maximize their tax savings while complying with all relevant tax regulations. Its robust tax planning tools enable accounting firms to provide strategic advice to clients for minimizing tax liabilities and optimizing financial decisions.

TurboTax also offers advanced features for handling complex tax situations, such as rental property income, investments, and self-employment income. This versatility makes it an ideal solution for accounting firms serving clients with diverse tax profiles.

Additionally, TurboTax stays on top of the latest tax law changes and updates, making sure clients file taxes accurately and compliantly. The software’s ability to automatically import tax data from various sources, such as financial institutions and employers, streamlines data entry and reduces manual errors.

Furthermore, TurboTax provides electronic filing options, enabling accounting firms to submit tax returns electronically, ensuring quicker processing and faster refunds for clients. The software also offers audit support, providing peace of mind to both accounting professionals and their clients in the event of an IRS audit.

For accounting firms, TurboTax offers centralized management and reporting, facilitating seamless collaboration with clients and simplifying the process of handling multiple tax returns simultaneously. This centralized approach enhances efficiency, minimizes errors, and optimizes overall tax workflow management.

Rating and reviews for TurboTax:

- G2: 4.4 out of 5 stars, based on +94 user reviews.

- Capterra: 4.6 out of 5 stars, based on +10 user reviews.

H&R Block

H&R Block is a renowned tax preparation software that offers a comprehensive range of features and benefits tailored to meet the needs of accounting firms in search of effective tax solutions. With H&R Block, accounting firms can streamline their tax preparation processes, enhance client services, and efficiently manage their tax workflows.

Like TurboTax, H&R Block offers an intuitive and user-friendly interface that makes it accessible and easy to navigate for both accounting professionals and their clients. The software guides users through the tax preparation process step-by-step, ensuring accurate and thorough completion of tax forms and calculations. H&R Block likewise caters to various tax scenarios, including individual tax returns, small businesses, and more.

The software provides robust support for tax deductions and credits, ensuring that clients maximize their tax savings while staying compliant with tax laws and regulations. Its advanced tax planning tools enable accounting firms to offer strategic advice to clients, optimizing their financial decisions and minimizing tax liabilities.

Moreover, H&R Block keeps pace with the latest tax law changes and updates, ensuring accurate and up-to-date tax filings for clients. The software’s ability to automatically import tax data from various sources, such as financial institutions and employers, streamlines data entry and reduces manual errors. H&R Block also offers e-filing options for faster processing and quicker refunds.

For accounting firms, H&R Block offers centralized management and reporting, facilitating seamless collaboration with clients and simplifying the process of handling multiple tax returns simultaneously. This centralized approach enhances efficiency, minimizes errors, and optimizes overall tax workflow management.

Rating and reviews for H&R Block:

- G2: 4.2 out of 5 stars, based on +19 user reviews.

- Capterra: 4.3 out of 5 stars, based on +10 user reviews.

3. Audit software

Here are a few popular auditing tools used by accounting and CPA firms:

IDEA

While getting audited is nobody’s idea of a great time, IDEA by CaseWare, based in Ontario, makes the process more painless via powerful data analysis and data extraction. The tool is designed to support audit processes for accounting firms, seamlessly integrating with various solutions, including SAP, accounting tools, CRM systems, and more. By using IDEA, accounting firms gain access to a single version of the truth, enhancing the accuracy and efficiency of their audit procedures.

Users praise IDEA for its customizable features, allowing audit teams to tailor parameters according to each specific client’s needs. The software enables in-depth analysis of large volumes of data, facilitating the identification of discrepancies and variations within the data itself. Additionally, IDEA offers valuable support in sample selection for auditing, taking into consideration factors like materiality, gross positive/negative values, and confidence in other audit procedures performed.

One of IDEA’s key benefits is that it’s a huge time-saver, as it allows auditors to calculate and analyze large amounts of data with ease. The software simplifies the process of selecting representative samples from populations and performing various testing procedures. Furthermore, IDEA’s ability to import, sort, and group large quantities of data efficiently streamlines data analysis, enabling auditors to draw meaningful insights based on their set criteria.

For auditors, IDEA offers invaluable functionalities, such as creating pivot tables for large datasets with multiple variables, making it an indispensable asset in the audit process. With its logical approach and customizable features, IDEA streamlines sampling, data analysis, and the overall completion of audits.

However, some training or guidance may be needed to grasp all of IDEA’s functionalities fully. The software’s support and prompt assistance have also received positive feedback, adding to the overall positive experience of using IDEA for auditing purposes.

Rating and reviews for IDEA:

- G2: 3.9 out of 5 stars, based on +25 user reviews.

- Capterra: 4.4 out of 5 stars, based on +22 user reviews.

Diligent (formerly Galvanize & ACL)

Audit software ACL has undergone rebranding in recent years, first as Galvanize and then as Diligent, a move aimed at keeping up with changing industry needs and the capabilities of the software itself. Since its inception in 1987 as an analytics company, ACL has evolved into an analyst-renowned solution for risk management, compliance, and auditing.

By uniting these solutions in one platform and updating its branding, Diligent now presents an innovative tool that’s prepared to grow with the times. Identity crises aside, Diligent has emerged as a leading governance, risk, and compliance (GRC) software that empowers organizations to build resiliency and strategically manage risk and compliance. By providing executives with visibility, assurance, and confidence, Diligent enables organizations to reduce the cost of managing GRC programs, save time, and prevent errors through its unified platform. The software enables quick identification and mitigation of risks, ensuring adherence to compliance requirements.

By streamlining and automating critical workflows, Diligent fosters collaboration among teams and delivers real-time insights, supporting data-driven decision-making with minimal effort. Organizations can leverage pre-configured plug-and-play solutions for GRC programs and access powerful analytics and storyboards to gain deep insights into their operations.

Rating and reviews for Diligent:

- G2: 4.3 out of 5 stars, based on +133 user reviews.

- Capterra: 4.5 out of 5 stars, based on +86 user reviews.

4. Project and document management

Here are a few popular document management tools used by accounting and CPA firms:

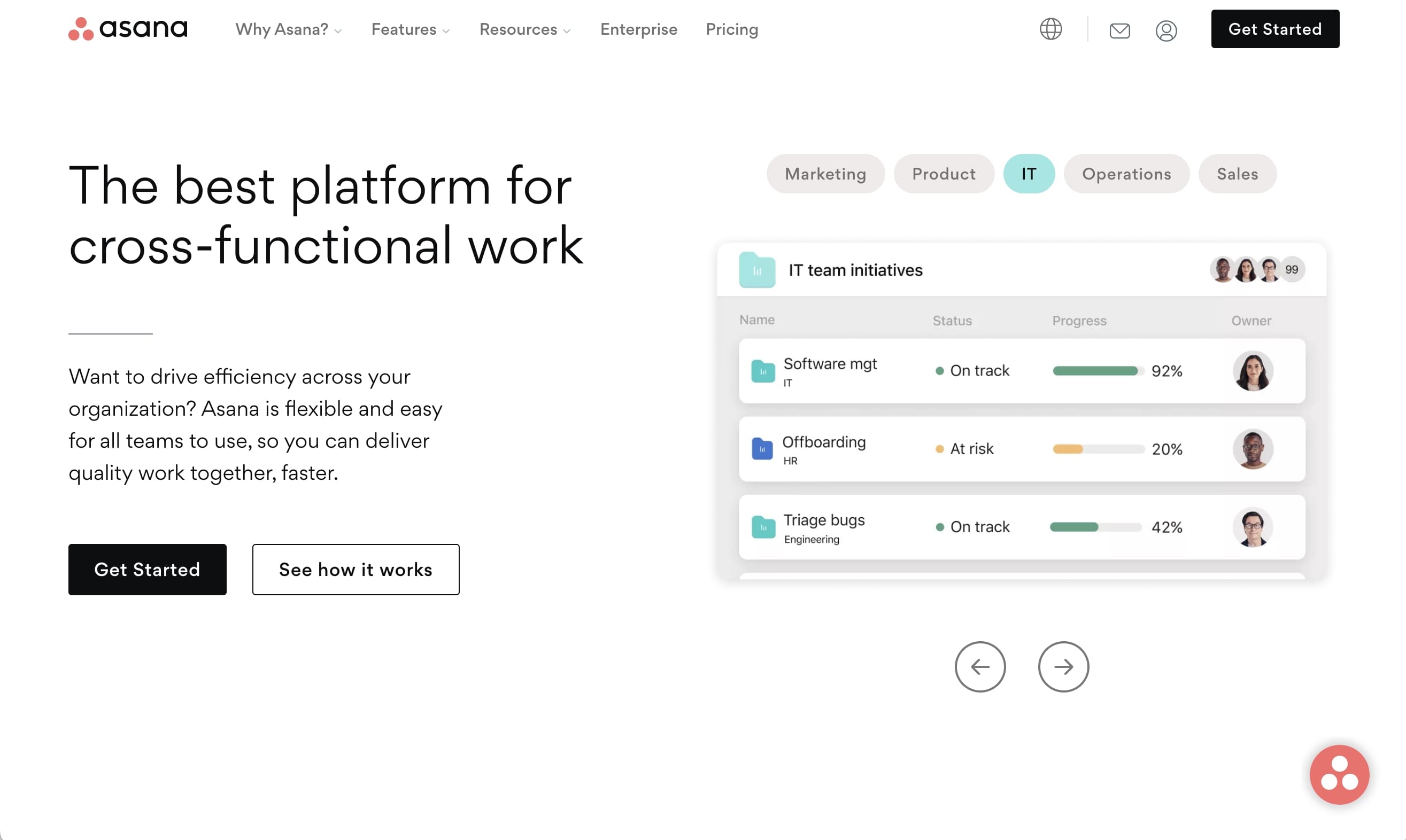

Asana

Asana is a feature-rich project management tool that offers various benefits to accounting firms, helping them streamline their workflows and enhance collaboration within their teams. With Asana, accounting firms can effectively manage their projects, tasks, and deadlines in a centralized platform, promoting efficient project execution and improved productivity.

Key features of Asana include task management and tracking, customizable workflows, collaborative tools for teams and client work, project planning and progress tracking, and overall greater clarity on project milestones. Asana also integrates with various other tools and software commonly used by accounting firms, such as cloud storage services, communication platforms, and time-tracking software.

By providing a clear overview of tasks and deadlines, Asana helps accounting teams stay focused and productive, reducing the risk of missing critical deadlines. Real-time collaboration features in Asana facilitate effective communication between team members, leading to better coordination and fewer miscommunications.

Rating and reviews for Asana:

- G2: 4.4 out of 5 stars, based on +10,695 user reviews.

- Capterra: 4.5 out of 5 stars, based on +13,219 user reviews.

Monday.com

Monday.com is another versatile project management tool that offers a wide range of features and benefits to accounting firms seeking efficient project management solutions. With its user-friendly interface and customizable workflows, Monday.com empowers accounting teams to streamline their projects, enhance collaboration, and stay organized.

From client onboarding to financial reporting, teams can design workflows in Monday.com that align with their specific processes. In terms of task management, accounting teams can easily create, assign, and track tasks and gain clear visibility of task statuses, deadlines, and responsibilities.

With Monday.com’s intuitive project planning tools, accounting firms can create timelines, set dependencies, and visualize project progress. This feature aids in effective project scheduling and resource management. By centralizing project-related information and tasks, Monday.com helps accounting teams work more efficiently and meet project deadlines.

Rating and reviews for Monday.com:

- G2: 4.7 out of 5 stars, based on +12,663 user reviews.

- Capterra: 4.6 out of 5 stars, based on +5,333 user reviews.

Google Drive

You may already be familiar with Google Drive as a powerful cloud-based file storage and collaboration platform that offers a host of features and benefits for accounting firms. With its seamless integration with other Google Workspace tools, Google Drive provides a convenient and secure solution for document management and collaboration.

Google Drive allows accounting firms to store and organize files in a centralized and easily accessible location. Easily create folders and subfolders to organize financial documents, client information, and reports, while also collaborating with other team members in real-time and eliminating version control issues. When you need to share documents with team members or external stakeholders, you can control the permissions as to who can view, edit, or comment on files.

It’s also easy to access Google Drive from any device, providing accounting professionals the flexibility to work on files from the office, home, or on the go. If your travels take you offline, you can enable offline access to files and sync new changes once you’re back online. Meanwhile, Google Drive employs robust security measures to protect files and data, providing accounting firms with peace of mind regarding the safety of sensitive financial information.

5. Client communication, CRM, and portal software

Assembly

Rounding out our list of the best software for accounting firms is Assembly, a leading client communication, CRM, and portal software. It’s one of the most comprehensive platforms to streamline client interactions and enhance overall accounting practice management. With its range of features and integrations, Assembly is hands-down the best solution for creating a delightful client experience. Let’s go over some of the noteworthy features and benefits:

- Assembly offers a centralized client communication hub, allowing accounting firms to interact with clients through dedicated client portals. Securely exchange messages, share documents, and collaborate in real-time without breaking a sweat.

- Likewise, clients can easily interact with their accountants, ask questions, and provide necessary information, fostering a stronger professional relationship.

- Assembly excels in document management, providing intuitive organization and storage features. Accounting firms can effortlessly organize and retrieve important client files, ensuring efficient access to vital financial information.

- Recognizing the importance of automation in reducing manual effort, Assembly offers automation features that handle repetitive tasks, such as client onboarding and intake forms. If you like the idea of freeing up your time for higher-value activities, Assembly is worth a try.

Overall, Assembly’s seamless communication and collaboration features enhance the overall client experience, making it easier for clients to interact with accounting professionals and stay updated on financial matters. Effective communication and collaboration through Assembly’s client portal foster stronger relationships between accounting firms and their clients, leading to greater client satisfaction and loyalty. Assembly’s features also enable accounting firms to maintain compliance with industry regulations and present a professional image to clients.

Rating and reviews for Assembly:

- G2: 4.8 out of 5 stars, based on +186 user reviews.

- Capterra: 4.9 out of 5 stars, based on +21 user reviews.

Modern accounting firms run on Assembly

With client expectations at an all-time high, particularly following the pandemic, clients expect accounting firms to have a robust online presence with access to digital services. This includes cloud-based accounting, online bookkeeping, and mobile applications for effortless access to financial information. Furthermore, the need for real-time data and analytics has become paramount, enabling clients to make informed decisions promptly. Accounting firms must embrace digital transformation to meet these expectations and provide a seamless and dynamic client experience.

Toward that end, modern accounting firms recognize the significance of embracing cutting-edge software for accounting firms to stay competitive and deliver exceptional client experiences. As we explored the top five best software options for accounting and CPA firms in 2025, one software solution emerged as the driving force behind transformative practices: Assembly.

With its feature-rich platform designed specifically for accounting professionals, Assembly has revolutionized the way accounting firms manage their client relationships, streamline workflows, and communicate effectively. Its powerful capabilities, such as the centralized client portal, integrated CRM, and seamless collaboration tools, make it the ultimate choice for modern accounting firms aiming to redefine the client experience. Assembly’s ability to centralize client interactions, automate tasks, integrate with other apps, and enhance collaboration enables firms to redefine the client experience, foster stronger relationships, and deliver unmatched client satisfaction.

As technology continues to reshape the accounting landscape, accounting and CPA firms that harness the power of Assembly and other advanced software offerings are well-positioned to thrive in an increasingly competitive industry. With Assembly as their solution of choice, modern accounting firms are empowered to navigate the challenges of the future, setting new standards of excellence in the accounting profession. To experience Assembly for yourself, sign up for a free trial!