Top 6 TaxDome alternatives for 2025 [tested and reviewed]

TaxDome alternatives are worth exploring if your firm finds TaxDome’s pricing restrictive. Here are 6 competitors that make client work easier in 2025.

![Top 6 TaxDome alternatives for 2025 [tested and reviewed]](/content/images/size/w2000/2025/10/Assembly_Thumbnail--6-.jpg)

I tested dozens of accounting platforms to see which matched or outperformed TaxDome. These 6 TaxDome alternatives delivered stronger automation and easier customization in 2025.

6 Best TaxDome alternatives: At a glance

TaxDome alternatives cover everything from accounting workflows to full client portals for billing, messaging, and automation. Each one serves different types of firms depending on how they handle client work and internal processes. Here’s how pricing, best use cases, and advantages compare:

| Alternative | Best For | Starting Price (Billed Annually) | Key Advantage vs TaxDome |

|---|---|---|---|

| Assembly | Client portals and CRM in one platform | $39/month | Combines billing, forms, and client messaging in one place |

| Canopy | Modular accounting workflows | $45/user/month for the Starter small firms plan | Lets firms pay only for the modules they need |

| Karbon | Email-based workflow management | $59/user/month | Adds structure for collaboration and task tracking |

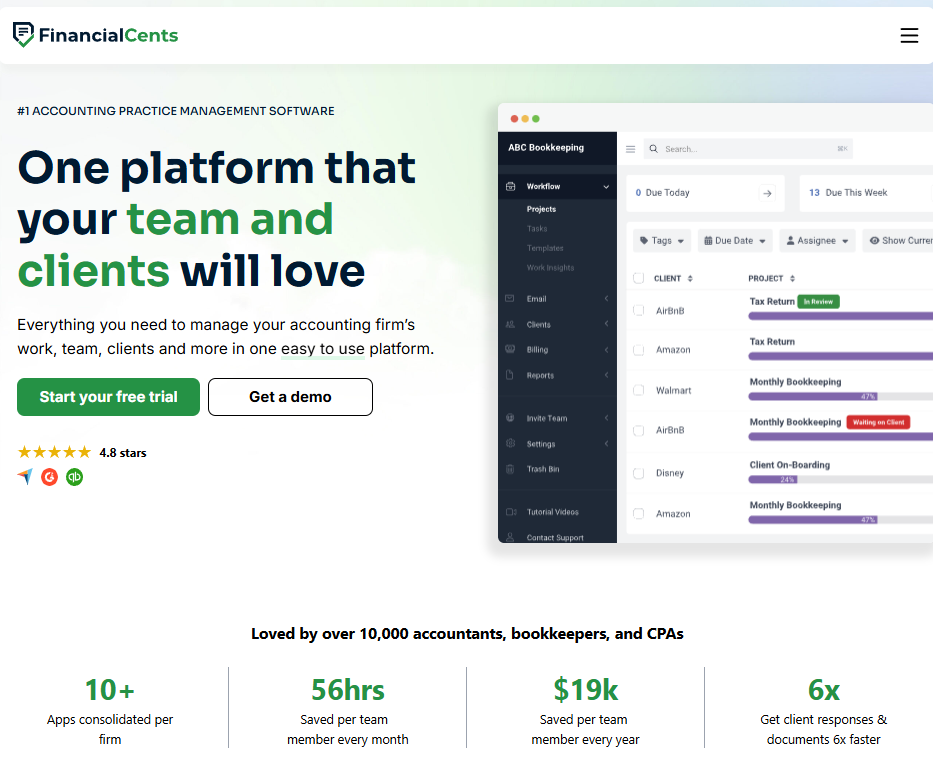

| Financial Cents | Simple automation for small firms | $19/month | Handles recurring jobs without complex setup |

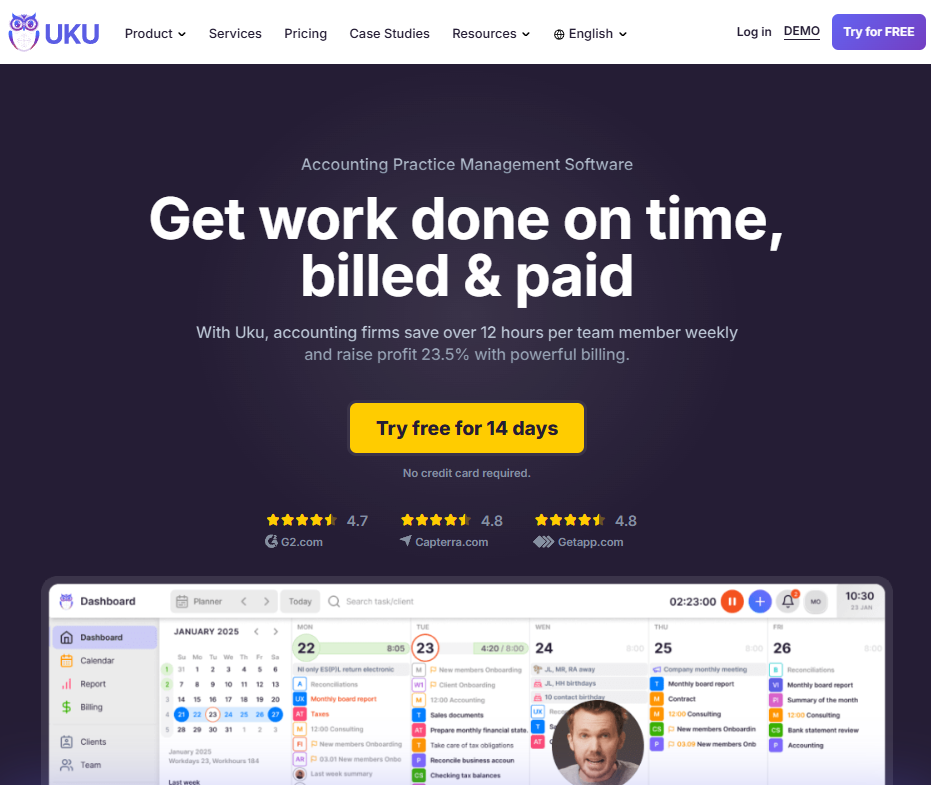

| Uku | Task tracking and billing in one view | $38/user/month | Links time tracking directly to invoices |

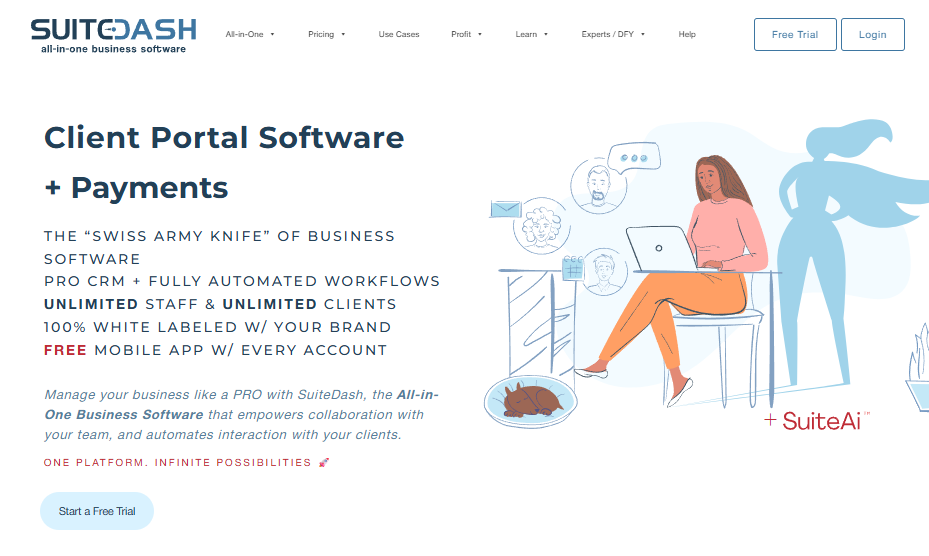

| SuiteDash | Custom portals with advanced control | $180/year | Provides white-label portals with flexible permissions |

Why I looked for TaxDome alternatives

TaxDome brings solid automation to accounting and tax workflows, but after working with it firsthand and talking with firm owners, I noticed where it starts to feel restrictive. For small teams, setup takes time and training, while larger firms often hit limits when trying to adapt workflows or manage branding inside the client portal.

Even though it centralizes documents and e-signatures, scaling up can get expensive fast. Every new user adds cost, and the annual billing model doesn’t give much flexibility for growing or seasonal teams.

From testing and user feedback, these are the three main reasons teams look for TaxDome competitors:

- Setup time: Getting workflows and automations running takes longer than most teams expect.

- Rigid structure: Customizing client views, permissions, and branding is limited.

- TaxDome pricing: The annual license adds up as teams expand, with few options for monthly flexibility. I also wrote a guide for TaxDome pricing if you’d like to learn more.

1. Assembly: Best for client portals and CRM in one platform

We built Assembly as a client portal and CRM for service firms. Service firms often juggle multiple systems for billing, contracts, and communication, which slows work and causes extra admin. Assembly combines these jobs in one organized space so your clients can log in, view invoices, sign contracts, send files, and message your team without switching tools.

The billing and contracts app includes invoicing, e-signatures, subscriptions, and payment collection in one view. Secure messaging and file sharing keep updates organized for both your team and your clients.

Assembly connects with Airtable, ClickUp, and Calendly, and integrates with Zapier and Make for automation. Each client gets a branded, white-label portal that reflects your firm’s identity while keeping data secure under SOC 2, HIPAA, and GDPR standards.

We also launched Assembly Assistant, an AI-powered colleague that knows each client’s history, files, and notes. It helps your team prepare for calls faster, surface the right context, and draft updates without searching through old threads or documents.

Why it beats TaxDome

- Faster onboarding: You can set up portals, import clients, and send invites within hours.

- Custom branding: Each client workspace matches your logo, colors, and domain.

- Integrated messaging: No need for email threads or third-party chat apps.

- AI context assistant: Assembly Assistant surfaces client history and notes automatically before meetings.

- Flexible integrations: Connect with tools like Airtable, ClickUp, and Calendly through Zapier or Make to match your existing workflow.

Pros

- Combines payments, contracts, and messages in one place.

- White-label experience for every client.

- Strong automation and third-party integrations.

Cons

- Lacks deep accounting reports.

- Some advanced automation features are available on higher plans.

Pricing

Assembly’s pricing is transparent and predictable, starting at $39 per month for one internal user and up to 50 clients.

Bottom line

Assembly helps firms reduce admin by bringing billing, contracts, and client communication into one branded portal. This setup shortens onboarding, improves visibility, and keeps every client interaction connected. However, firms focused on tax preparation or advanced reporting may find Canopy or Financial Cents a better fit.

2. Canopy: Best for modular accounting workflows

Canopy focuses on structure without locking firms into a single setup. I tested its workflow, billing, and document tools separately to see how modular pricing affects usability. Each feature works as a standalone app, which makes it easier for teams to add functionality as they grow.

I liked how the task dashboard connects projects and deadlines without creating clutter, and the built-in document manager includes e-signatures and secure sharing. For firms managing tax, payroll, and advisory work together, the time tracking and invoicing tools bring financial data into one view without needing another system.

Why it beats TaxDome

- Modular pricing: Start with the base client platform, then add only the modules your firm needs.

- Compliance-ready workflows: Time tracking, billing, and document management fit accounting standards.

- Custom dashboards: Managers can monitor workload and progress across teams in real time.

Pros

- Flexible pricing and add-on options.

- Clean task and document interface.

- Built-in e-signatures for faster approvals.

Cons

- Some modules cost extra.

- Custom automation requires higher tiers.

Pricing

Canopy pricing starts at $45 per user per month for the Starter plan for small firms.

Bottom line

Canopy helps firms stay organized by connecting documents, billing, and client communication in one place. Its modular pricing makes it easy for teams to pay only for the tools they actually use, though smaller firms may find Financial Cents or Jetpack Workflow more practical.

3. Karbon: Best for email-based workflow management

Karbon structures collaboration around shared inboxes and tasks. I tested how it manages jobs and emails together, and it’s clear that visibility is its strongest trait. Messages turn into assignable tasks, helping teams reduce email backlogs and improve accountability.

I liked that the timeline view shows every update tied to a client or project, which makes it easier to track progress in real time. Automations handle recurring jobs and reminders, while analytics summarize team performance without manual reporting.

Why it beats TaxDome

- Email-to-task conversion: Turns messages into actionable tasks to cut inbox clutter.

- Team visibility: Tracks every update through shared timelines and client records.

- Built-in automation: Handles recurring reminders and scheduling for ongoing client jobs.

Pros

- Strong email-to-task connection.

- Clear visual dashboards.

- Helpful automations for recurring jobs.

Cons

- Learning curve for new users.

- Limited external integrations.

Pricing

Karbon pricing starts with the Team plan, which costs $59 per user per month.

Bottom line

Karbon works well for firms that manage large volumes of email-based work and want stronger accountability across teams. Firms that want more direct client interaction or a branded portal might prefer Assembly or SuiteDash.

4. Financial Cents: Best for simple automation for small firms

Financial Cents helps small accounting teams automate repetitive jobs without extra setup. I used it for recurring client work like payroll and reconciliations, and it handled task assignments and reminders with minimal effort. Each client profile shows progress, ownership, and due dates in one clear view.

I liked how automations trigger follow-ups when deadlines approach, keeping jobs on track without constant oversight. Reports give managers quick visibility into workload and delays without manual tracking. It’s straightforward and practical for teams that want structure without the complexity of enterprise workflow tools.

Why it beats TaxDome

- Simple workflow setup: Automates recurring jobs without complex configuration.

- Transparent task tracking: Keeps staff accountability visible across all clients.

- Low learning curve: Teams can get started quickly without formal onboarding.

Pros

- Easy to learn.

- Great for recurring client jobs.

- Transparent reporting dashboard.

Cons

- Limited integrations.

- No built-in client portal.

Pricing

Financial Cents starts at $19 per month for single-user firms.

Bottom line

Financial Cents simplifies job tracking with clear visibility and quick automation. I think it’s ideal for firms that want reliable organization without extra tools. However, larger firms that depend on complex approvals or custom reporting might prefer Canopy or Karbon.

5. Uku: Best for task tracking and billing in one view

Uku combines task tracking, time management, and billing into a single system. I used it to build recurring workflows for accounting projects and found the automation to be efficient. Managers can see staff workloads, task progress, and hours logged for each job, which helps balance responsibilities across the team.

I liked that time tracking links directly to invoices, eliminating manual entry and improving billing accuracy. Custom templates for repeat jobs like reconciliations or monthly reporting help maintain consistency across clients. Automations also adjust deadlines when schedules shift, reducing admin work. For firms that want order without rigid systems, Uku keeps projects transparent.

Why it beats TaxDome

- Linked time tracking: Connects hours to invoices for accurate billing.

- Custom templates: Simplifies setup for recurring accounting work.

- Workload visibility: Displays task progress for every staff member.

Pros

- Combines billing and time tracking.

- Real-time progress visibility.

- Good for structured accounting work.

Cons

- Limited integrations outside accounting tools.

- Interface can feel busy with many tasks.

Pricing

Uku pricing starts at $38 per user per month, which includes unlimited clients and imports.

Bottom line

Uku helps firms plan recurring accounting jobs and bill clients accurately in the same system. It’s structured but adaptable enough for small to mid-size teams. Firms that need broader client communication or integrated file sharing may prefer Assembly or Client Hub.

6. SuiteDash: Best for custom client portals with advanced control

SuiteDash brings client portals, billing, and project management together in a flexible platform. I tested how its permissions and automation tools handle different client roles, and the customization was extensive. Firms can design branded dashboards, assign access levels, and automate what each client sees based on service type.

Built-in CRM tools track conversations and contracts alongside payments, while workflow automation keeps every project moving. I liked how the system keeps staff and clients working in the same interface without extra plugins. SuiteDash is strong for growing firms that manage multiple service lines or need detailed access control.

Why it beats TaxDome

- Custom portals: Create branded, role-specific dashboards for clients.

- Advanced permissions: Control what each user can view or edit.

- All-in-one setup: Combines CRM, projects, and billing in one tool.

Pros

- Highly customizable client experience.

- Combines CRM, billing, and automation.

- Secure role-based access control.

Cons

- Steeper learning curve.

- Interface can feel overwhelming at first.

Pricing

SuiteDash starts at $15 per user per month for the Starting Smart plan.

Bottom line

SuiteDash gives firms flexibility with white-label portals and permission control that fit different client types. It helps unify work across departments without extra software. Firms that want a simpler setup or lighter automation could consider Jetpack Workflow or HoneyBook instead.

How I tested these TaxDome alternatives

I spent several weeks testing each TaxDome alternative by running mock accounting and consulting projects. I created client portals, sent contracts and invoices, shared files, and tracked deliverables from kickoff to payment. My goal was to see how well each platform handles active client work once projects are live, from task tracking to communication and billing.

Here’s what I focused on during testing:

- Onboarding flow: I built mock client accounts to test how quickly teams can move from proposal to first deliverable without external tools.

- Automation quality: I measured how much manual work each platform removes across recurring jobs, document requests, and status updates.

- Client visibility: I checked whether clients could find files, invoices, and messages easily without asking for updates.

- Workflow control: I tracked how flexible task assignments and permissions were for growing teams.

- Data integrity: I tested whether billing and reporting stayed accurate when multiple users worked on the same project.

This hands-on testing helped me see which platforms simplify client operations and which ones still leave teams managing work across disconnected systems.

How to choose your TaxDome alternative

Choosing a TaxDome alternative starts with understanding what your firm needs beyond automation. Some teams want faster onboarding or simpler client portals, while others look for flexibility with billing or reporting. Choose:

- Assembly if you want an all-in-one platform where clients can sign contracts, pay invoices, and message your team in one secure portal.

- Canopy if your firm needs modular tools for billing, task management, and document handling under one system.

- Karbon if your team prefers detailed workflow visibility and communication tools built around email.

- Financial Cents if you want easy automation for recurring work without a heavy learning curve.

- Uku if you want built-in time tracking that connects directly to invoices and job templates.

- SuiteDash if you need full control over client permissions and branded portals for multiple service lines.

The right TaxDome alternative should make client management faster and clearer without forcing your team into rigid systems. Choose the one that gives your clients visibility and keeps your internal work organized with less admin.

My final verdict

TaxDome gives accounting and professional service firms structure, but it can feel restrictive once client work grows beyond standard templates and document sharing.

Teams that want faster setup often choose Financial Cents or Jetpack Workflow for simpler automation, while firms needing more control over billing or customization tend to use Canopy or Ignition. These tools handle parts of the process, yet most still require switching between systems for contracts, payments, and updates.

We built Assembly to solve that problem. It connects billing, contracts, communication, and reporting in one branded client portal where clients can sign, pay, and stay informed without extra admin. That connection helps firms stay organized after onboarding and gives clients the visibility many tools lack.

Ready to switch from TaxDome? Start here

Many firms start searching for a TaxDome alternative once rigid templates and workflows begin slowing them down. As client operations expand, flexibility becomes more important than structure alone. Assembly brings billing, contracts, and communication together in one connected platform that adjusts to how your team actually works.

Here’s what you can do with Assembly:

- See the full client record: Notes, files, payments, and communication history stay linked in one place. You never have to flip between systems or lose context when switching from sales to service.

- Prep faster for meetings: The Assistant pulls past interactions into a clear summary so you can walk into any call knowing exactly what’s been discussed and what’s next.

- Stay ahead of clients: Highlight patterns that may show churn risk or upsell potential, making outreach more timely and relevant.

- Cut down on admin: Automate repetitive jobs like reminders, status updates, or follow-up drafts that used to take hours. The Assistant handles the busywork so your team can focus on clients.

Ready to try a TaxDome alternative that keeps your firm flexible and connected? Start your free Assembly trial today.

Frequently asked questions

Is there a good free TaxDome alternative?

No, there are no true free TaxDome alternatives that offer full workflow, billing, and document automation. However, you can try platforms like Canopy, Financial Cents, and Dubsado for free with limited-time trials.

Which tool is best if I only need client portals (not full practice management)?

Assembly and SuiteDash are the best options if you only need client portals rather than full practice management. Both provide secure, branded portals where you can share files, collect payments, and manage client communication from one login. They’re solid choices for firms that want a professional, centralized client experience without the added complexity of full accounting automation.

What’s the best TaxDome alternative for small business owners?

Financial Cents and Assembly are the best TaxDome alternatives for small business owners who want simple automation and an easy client experience. Financial Cents helps track recurring jobs and automate reminders with minimal setup, while Assembly provides a branded client portal where clients can sign contracts, pay invoices, and message your team in one place.

Can SEO firms use TaxDome alternatives for client management?

Yes, some platforms like Assembly can double as SEO client management software, helping agencies track projects, deliverables, and payments in one place. These tools centralize client communication and feedback, making it easier to manage campaigns and reporting without moving between multiple systems.