TaxDome vs Canopy: An honest comparison for 2025

Comparing TaxDome vs Canopy for your accounting firm or CPA practice? We put these tools head to head to help you make a decision on which to go with.

If you’re a freelancer or agency providing accounting and CPA services, you’ll know how competitive it is out there. Financial regulations are shifting and changing, and clients seem to become more demanding each tax season. Of course, on a personal level, achieving a good work-life balance is one of the most grueling parts of the job.

Thankfully, there is a fine new wave of software that is built to solve these problems (and more). TaxDome and Canopy are two of the best options out there for accountants and CPAs. If you’re on the hunt for a software solution that makes managing your clients simple, and you’ve narrowed your search down to these two solutions, this article could be just what you need to make your final decision.

So, let’s perform a detailed TaxDome vs Canopy comparison to see which solutions are best for your business.

Brief overview of TaxDome vs Canopy

TaxDome and Canopy are two of the more popular practice management platforms for tax, bookkeeping, and accounting firms. While they share a bunch of similar functions and features, each solution is aimed at a slightly different market.

As an all-in-one tool, TaxDome is packed with features that make it a solid choice for small freelance accounting and bookkeeping teams. However, one criticism you could level at TaxDome is that while the breadth of features on offer is highly impressive, the depth of functionality lags a bit behind its rivals. But don’t let that put you off because it will work well for most small accountancy firms.

Canopy, on the other hand, is geared towards mid-size accounting teams. It started out life as a tax resolution tool, and that legacy is still present. We’ll explain it further below, but Canopy’s integration with the IRS Transcript Delivery System (TDS) is a solid feature, while it also comes with AI and RPA tools that help automate workflows. Overall, its power lies in its ability to make life easier for your clients, thanks to fantastic communication options and a quality client portal.

But to really understand each tool, we need to compare them head-to-head. So, let’s get into it.

TaxDome vs Canopy: Top features comparison

If you’re trying to differentiate between TaxDome and Canopy, the first thing you need to do is a feature comparison. Let's take a gander at the features that you need from an accountancy-friendly service-based platform to see how they compare.

Integrations

Let’s take a look at how both TaxDome and Canopy integrate with other tools in your accounting tech stack.

- TaxDome: Zapier integration is one of TaxDome’s most significant selling points. This partnership allows you to connect TaxDome to thousands of great apps that are perfect for accountants, such as tax processing tools, payment processors, and bookkeeping tools.

- Canopy: Canopy also excels at integration. It fuses well with Zapier but also provides seamless connections to API, email, and QuickBooks. However, the standout feature for accountants is Canopy’s integration with the IRS. This allows Canopy customers to log in to the Transcript Delivery System (TDS) to automate the retrieval and monitoring of client’s transcripts.

Client portal

With any tool to help manage your client interactions, a client portal is a necessity. Both TaxDome and Canopy offer a client portal feature. However, they aren’t as flexible as something like Assembly — which is designed with a client portal at the core of its feature set.

- TaxDome: Solid client portal that facilitates document exchange, e-signatures, task management, and payments, all from a dedicated client page.

- Canopy: Canopy has a similar client portal feature. Both apps' client portals are secure and white-labeled, allowing you to brand them for your service.

Invoicing & billing tools

Invoicing and billing is how you get paid. Let’s look at how TaxDome and Canopy handle these.

- TaxDome: TaxDome has powerful invoicing and billing tools. These allow you to collect from credit and debit cards and payment processors like Stripe and PayPal. There’s also the option to set up recurring payments, which will come in very handy if you want to productize your service.

- Canopy: Canopy has superb time and expense management options, which make billing a breeze. It also supports cards, payment processors, and recurring billing.

Contracts

Whether you need to create a contract for your services or need your clients to sign documents electronically, both Canopy and TaxDome offer contract features.

- TaxDome: TaxDome comes with a wide range of contract templates, e-signature capabilities, and secure contract management.

- Canopy: Canopy has great contract management options. It also supports e-signatures.

Communications

Keeping your clients in the know is key to offering a great client experience. Here’s how both platforms approach communications.

- TaxDome: The client portal offers good in-app messaging options, as well as functionalities that allow for bulk messaging and automated email notifications.

- Canopy: Canopy has similar communication options. However, with the right setup, you can use workflow triggers for automated communication.

Client CRM

Managing clients, onboarding them, and keeping track of the stage they are in their interaction with you it key to keeping a healthy service-based business. Here’s how both platforms approach their CRM features.

- TaxDome: Solid CRM features that help you manage leads, onboard clients, and have easy access to customer information and conversations, facilitating a more personalized service.

- Canopy: The Canopy CRM is probably its best feature. It’s powerful, flexible, and packed full of features that help boost task management for clients.

File storage

Uploading sensitive documents for review and signing is an integral part of running an accounting firm. Here’s how both platforms manage this.

- TaxDome: TaxDome offers its customers secure and unlimited file storage alongside solid access control options for your clients or team.

- Canopy: Canopy also offers secure file storage. However, you’ll need to get a higher tier to unlock unlimited storage.

Client intake forms

When it comes to onboarding, the more you know about your client the better. Using a client intake form is a great way to tailor your services to your client’s exact needs. Here’s how both platforms manage this feature.

- TaxDome: TaxDome comes out on top for building client intake forms because it offers a greater degree of customization. You can also use it to collect specific data, onboard clients, and even generate professional-looking documents.

- Canopy: Canopy has good options for building client intake forms with questionnaires. However, it lags behind TaxDome’s flexibility.

Knowledge base

To help reduce customer support inquiries, many businesses use a knowledge base (or helpdesk) to allow their customers to find answers to their own questions. Here’s how both TaxDome and Canopy manage this.

- TaxDome: Offers wiki pages for onboarding employees, standard operating procedures, and other training materials.

- Canopy: Canopy doesn’t offer the same knowledge base features. However, you can share and store documents via the client portal.

Overall, TaxDome and Canopy offer a fairly similar feature set, with some exceptions. However, if you’re looking for a tool that excels at all of these features and offers AI automation, Assembly provides serious value thanks to its huge level of document customization.

TaxDome vs Canopy: Use cases comparison

Another good way to evaluate each tool is to look at their respective use cases and what sort of teams they are best suited to.

TaxDome use cases and ideal customers

TaxDome’s primary use cases are:

- Thanks to TaxDome’s client portal and secure messaging features, it’s a great tool for streamlining client communication.

- TaxDome has solid payment processing feature integrations alongside options for recurring billing and automatic payment reminders.

- Solid automation options can help you cut down on tedious manual tasks like tax filing.

When it comes to its strengths, TaxDome is best for:

- Sole proprietors and smaller accountancy firms

- Firms who want to unlock the benefits of streamlining tasks through automation

- Teams that need the flexibility to customize their workflows and client interactions

Canopy use cases and ideal customers

The primary use cases that help Canopy stand out include:

- Supporting accountants that offer tax resolution services

- Excel practice management with solid workflow and document tools

- Facilitating data-driven approach to accountancy practice performance

When it comes to its strengths, Canopy is best for:

- Mid-size accountancy practices and forms

- Forward-looking accountants who want to future-proof their business

- Teams who want to boost communication with clients and enhance employee collaboration.

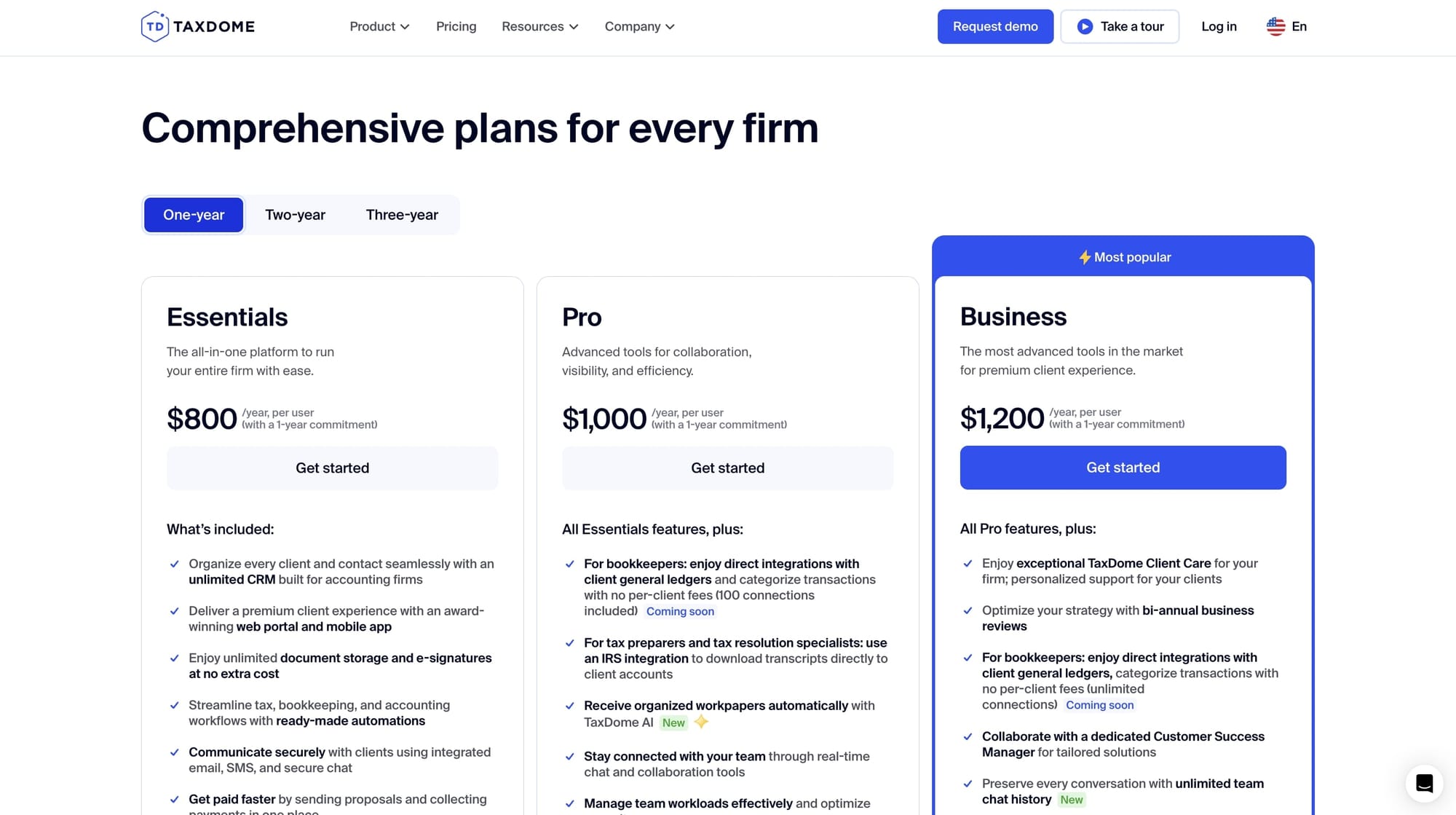

TaxDome vs Canopy: Pricing comparison

When it comes to pricing, there is no comparison between the tools. Let’s see why.

TaxDome offers its services for a flat fee of $800 per user per month. For that reasonable fee, you get access to all the tools’ great features, unlimited contacts, and discounts for each seat that you have.

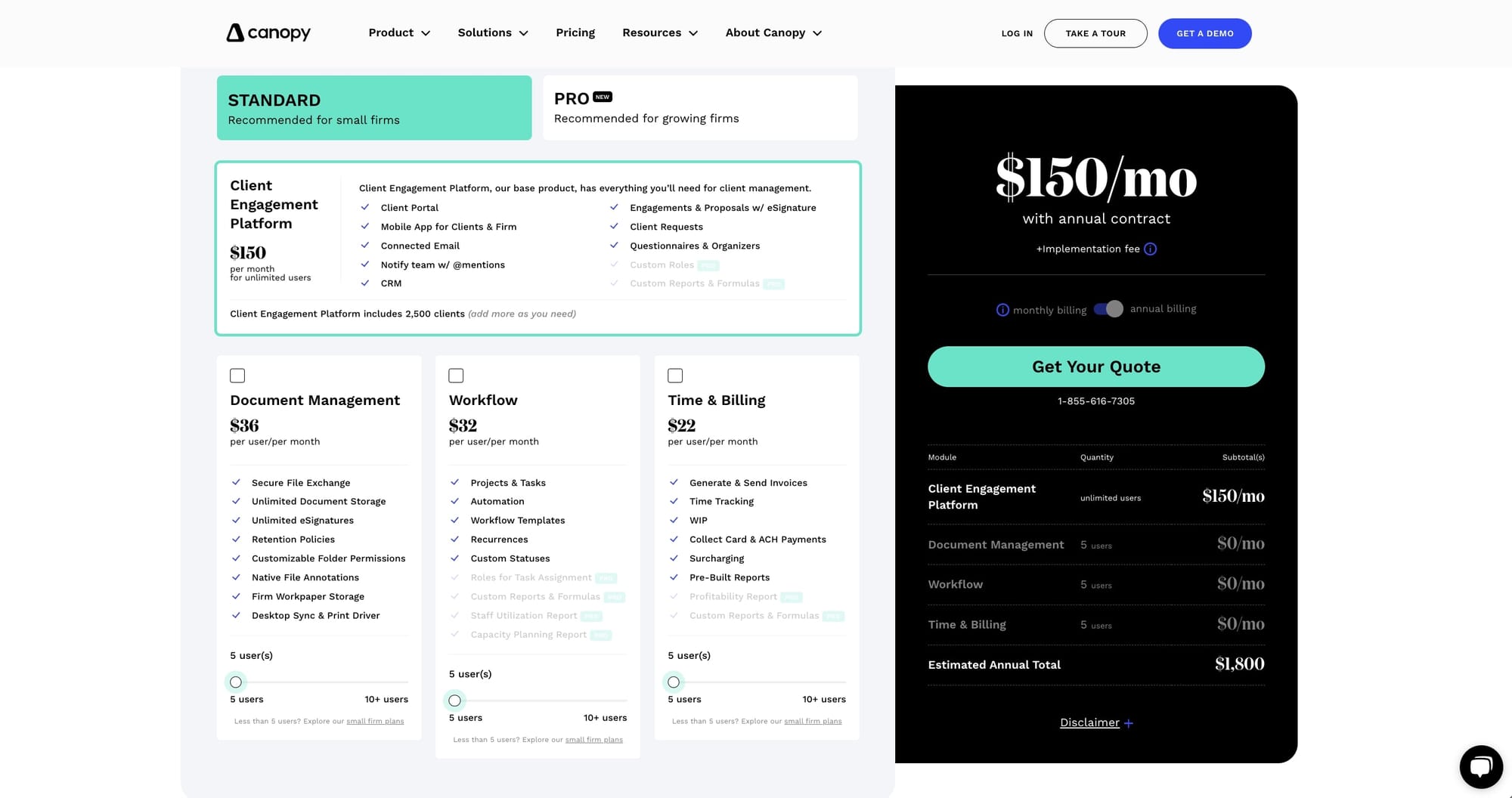

Canopy, on the other hand, has a much more complex pricing system. They use a modular pricing approach, which means you pay for each additional service that you require.

Canopy's Standard plan, which starts at $150 per month, gives you unlimited clients. However, as you add more, the price rises.

Features like document management, workflow, and time and billing tools, drive up the monthly fees for Canopy, too. For example, If you need document management, it costs an extra $36 per month per feature.

So, overall, you have a choice. Canopy is more affordable but a little less advanced. While TaxDome is more expensive, but you get a lot for the price.

However, if you’re looking for the best price-to-feature set ratio, Assembly is where it’s at. You get all the tools in the features section above, but at a more reasonable price.

TaxDome vs Canopy: Pros and cons comparison

TaxDome and Canopy are both solid pieces of software with some serious benefits for freelance accountants, CPAs, and accounting agencies. However, like any tool on the market, they have some weaknesses that you need to know about before you make a purchase.

Let’s look at the pros and cons of each tool, so you can make the most informed choice.

TaxDome pros and cons

Let's look at some of the pros and cons of TaxDome.

Pros:

- TaxDome is a great all-in-one solution that will please smaller accounting agencies and freelancers. It comes with a suite of tools, such as a CRM, client portals, document management, e-signatures, and tax preparation features.

- Responsive customer support is a big part of the TaxDome offer. Customers highlight the variety of support options, tutorials, and genuine problem-solving expertise of support staff in helping them get them most from the platform.

- TaxDome’s workflow automation features let you automate various accounting tasks like bookkeeping, accounting, tax, and payroll.

- Another big plus of TaxDome is that they value customer feedback and use it to improve and update the product.

Cons:

- While TaxDome advertises its software at a flat fee of $50 per month per user, all subscriptions must be paid upfront. In effect, you need to pay $600 to get started, meaning you’re locked in for the year.

- Advanced automation features take a little getting used to.

- While TaxDome is an all-in-one tool, it lacks certain advanced features. While you can augment TaxDome via integrations, additional subscriptions are required.

Canopy pros and cons

Let's look at some of the pros and cons of Canopy.

Pros:

- Canopy has enough flexibility for accountants of every kind. It’s great for tax preparation, bookkeeping, and accountancy, but it also comes with robust task management tools, time tracking, and workflow tracking, which are guaranteed to make your business more efficient.

- Canopy helps you obtain IRS transcripts, allowing you to access tax client information with ease.

- The customer support offered by Canopy is first-class, especially for higher plans.

- Canopy is a good choice for client-focused teams. Excellent client portals, document sharing, e-signatures, and onboarding means the client experience is smooth and efficient.

Cons:

- Canopy is relatively expensive and it has a complex and confusing pricing structure. You do get a lot for your money, but whether or not it provides value is up for debate.

- While Canopy is flexible, it lacks the workflow customization options of other tools. What’s more, the document templates could be a bit more fluid.

- Canopy is very user-friendly on the client side. However, some tax professionals suggest that it has a steep enough learning curve, with workflow automation and integrations proving difficult for some customers to navigate.

TaxDome vs Canopy: Customer support comparison

Customer support is an important consideration for any freelance accountant or agency. Let’s see how each software fares.

TaxDome customer support

TaxDome typically has great customer service reviews, with many users of G2 commending the business for swift responses to any issues. Similarly, Capterra users rate the customer service at 4.7, which is a good sign. However, others feel that phone support is lacking.

TaxDome has a well-organized knowledge base/help center that is great for learning the ropes. What’s more, the Academy, Webinar, and Bootcamp sections promise to teach TaxDome functionalities in less than an hour.

TaxDome support options

TaxDome offers a flexible range of support options, including:

- Chat

- Phone support

- Knowledge base

- The vibrant Twitter/X and Facebook TaxDome community is a valuable resource.

Canopy customer support

Canopy customer service is rated 4.5 stars on Capterra. That’s a little lower than TaxDome’s 4.8, but it doesn’t necessarily mean there are any huge issues. In fact, a lot of Canopy customers are really positive about customer support, with some commending the company for listening to their customers and providing feedback.

Canopy customer support options are fairly similar to TaxDome and include:

- Chat

- Phone support

- Knowledge base

While Canopy doesn't have TaxDome’s vibrant community, there are lots of customer self-service options, with courses, webinars, boot camps, education, and blogs that cover everything you need to get the most from your time with the product.

TaxDome vs Canopy User reviews and testimonials

TaxDome and Canopy have solid customer reviews from third-party websites. Let’s take a look at both tools.

TaxDome reviews

There is no better way to evaluate a piece of software beyond finding out what real paying customers think of the solution. Here is what actual TaxDome and Canopy users have to say about these apps on third-party review sites.

- G2: 4.7 🌟 — “From seamless onboarding pipelines to secure client messaging and email, e-signature capabilities, customizable engagement letters, and an extensive template library, TaxDome simplifies and streamlines various aspects of accounting practice.”

- Capterra: 4.8 🌟 — “I like that TaxDome is all-inclusive, everything I need to manage my practice is in one package.”

- Software Advice: 4.8🌟 — “This has been a huge time saver for me without having to switch between multiple systems just to send an email or request key documents.”

Canopy reviews

- G2: 4.6 🌟 — “I like the UI/UX the best as it allows for shorter learning curves for onboarding new team members.”

- Capterra: 4.5 🌟 — “It's easy to use and even our clients have mentioned liking the client portal much more compared to previous software we've used.”

- Software Advice: 4.5 🌟 — “Love Canopy and can't imagine doing our jobs without it!! The support staff is outstanding both via chat and calling in.”

Conclusion

TaxDome and Canopy are both great options for accountancy freelancers and agencies. Both tools offer a diverse and robust set of features for managing your business and ensuring a first-rate experience for clients.

Overall, TaxDome is a great tool for its price. It offers a solid way to manage your freelance accountant firm or agency. However, when it comes to advanced functionality for accountants, it’s fairly reliant on integrations. Assembly offers better client management options and, excels at onboarding workflow automation, and provides branded, secure client portals that your clients will love.

Similarly, Canopy is a hi-tech option that is built for mid-size accounting teams. Some of its big advantages include excellent communication tools, solid practice optimization options, and, of course, great reporting & analytics tools. The drawbacks might include complex pricing and a modular set of features that can quickly add up. So, if you’re looking to get more value while still providing your users with super experiences, Assembly might have the edge.

In truth, it all comes down to what you need for your agency or practice. If you’re still not sure, try a free trial of Assembly today. You won’t be disappointed.